The banking, financial services, and insurance (BFSI) sector is transforming faster than ever. As digital technologies reshape customer expectations, compliance norms grow stricter, and AI-driven insights redefine decision-making, the role of banking professionals has evolved beyond traditional finance.

In 2026, success in BFSI is no longer just about numbers—it’s about adaptability, digital literacy, emotional intelligence, and strategic foresight. To stay competitive, every banker must continuously upgrade their skills through targeted BFSI training programs that address emerging industry needs.

In this post, we’ll explore the 7 essential skills every banker needs right now, the benefits of modern BFSI training, challenges organizations face, and how Ebullient Learning empowers professionals to thrive in the new financial era.

1. Digital Literacy and FinTech Awareness

The rise of FinTech innovations—from blockchain to AI-driven credit scoring—has changed the way banks operate. Professionals who understand these technologies can leverage them for smarter lending, better risk management, and personalized customer solutions.

Key aspects include:

-

Understanding blockchain and digital payments

-

Adapting to automation in operations and customer service

-

Using AI and analytics to improve efficiency

Why it matters:

A digitally literate banker not only keeps up with transformation but becomes a driver of innovation within their organization.

2. Data Analytics and Decision Intelligence

In 2025, data is the new currency. Banks now rely heavily on analytics for insights into customer behavior, risk profiling, fraud detection, and business forecasting.

Core skills to develop:

Data visualization using Power BI or Tableau

Statistical analysis for financial modeling

Data-driven decision-making for customer-centric outcomes

Professionals who can interpret complex datasets are invaluable assets in a world where accuracy and speed define success.

3. Regulatory Compliance and Risk Management

As global regulations evolve, compliance has become one of the most critical skill areas in BFSI. From AML (Anti-Money Laundering) laws to data privacy regulations, banking professionals must stay informed and proactive.

Essential training modules include:

-

Understanding RBI, SEBI, and IRDAI guidelines

-

Risk assessment and internal auditing

-

Ethical banking and governance

Outcome:

Trained professionals reduce organizational risk, ensure operational transparency, and build long-term customer trust.

4. Customer Relationship and Emotional Intelligence

Despite digitalization, banking remains a people-centric industry. Emotional intelligence, empathy, and communication are vital for creating exceptional customer experiences.

Key elements:

-

Handling customer complaints with empathy

-

Understanding client psychology and needs

-

Building long-term customer trust through transparent interactions

When combined with digital tools, emotional intelligence turns a banker into a trusted advisor, not just a service provider.

5. Cybersecurity Awareness

The BFSI sector is a prime target for cyber threats. With growing digitization, understanding cybersecurity basics is no longer optional—it’s essential.

Core areas of focus:

-

Identifying phishing, ransomware, and data breach risks

-

Implementing secure online banking protocols

-

Compliance with data protection and cybersecurity laws

Why it’s crucial:

Even one uninformed employee can jeopardize an entire system. BFSI training ensures your workforce acts as your first line of defense.

6. Sales, Cross-Selling, and Financial Advisory Skills

Modern bankers are also financial advisors—helping customers make informed investment decisions. Upskilling in consultative selling and cross-selling helps banks meet business targets while ensuring customer satisfaction.

Training focus:

-

Personalized financial advisory

-

Understanding market instruments (mutual funds, insurance, loans)

-

Ethical selling practices

These skills bridge the gap between customer needs and business growth, creating a win-win scenario.

7. Agility and Continuous Learning Mindset

In a rapidly evolving BFSI landscape, agility is the ultimate skill. Bankers who embrace lifelong learning adapt faster to new technologies, regulations, and customer behaviors.

What this means:

-

Staying current with digital transformation trends

-

Engaging in continuous professional development

-

Learning from cross-functional collaboration

A continuous learning culture turns challenges into opportunities and professionals into industry leaders.

Benefits of BFSI Training in 2026

Investing in BFSI training delivers tangible and long-term benefits for both individuals and organizations:

For Individuals:

-

Enhanced employability and promotion readiness

-

Increased confidence in handling complex financial tools

-

Broader understanding of technology-driven banking

For Organizations:

-

Improved compliance and operational efficiency

-

Stronger customer trust and satisfaction

-

Higher productivity and innovation within teams

BFSI training isn’t just an expense—it’s an investment in the future of financial excellence.

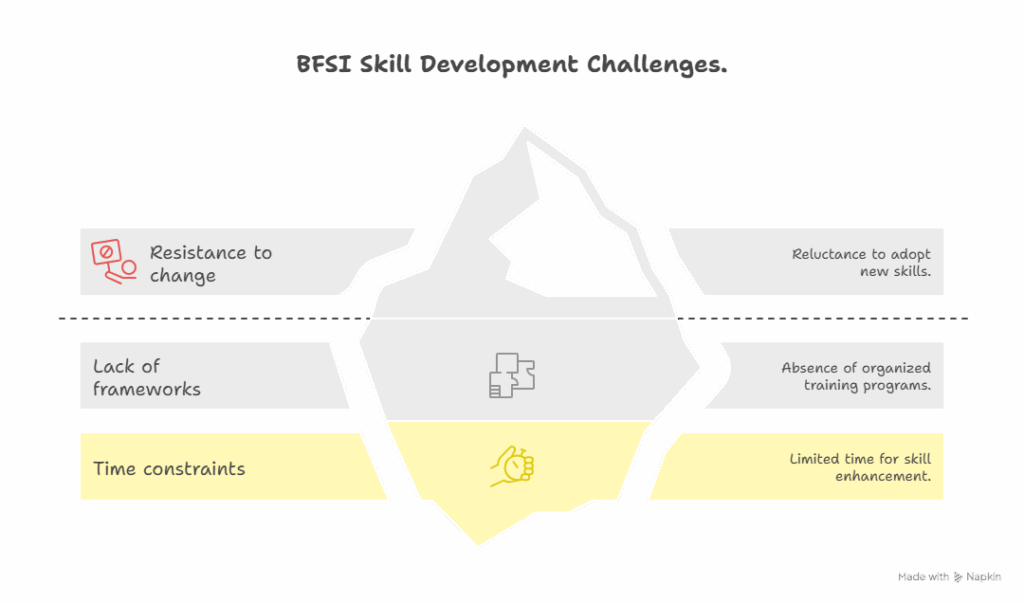

Challenges in BFSI Skill Development

While training is crucial, many organizations face roadblocks such as:

-

Resistance to change: Employees comfortable with legacy systems may resist digital upskilling.

-

Lack of structured training frameworks: Without proper roadmaps, learning becomes fragmented.

-

Time constraints: Bankers often struggle to balance training with daily operations.

The Solution:

Partnering with an experienced training provider like Ebullient Learning helps organizations overcome these barriers through customized, blended learning programs that fit seamlessly into work schedules.

Why Choose Ebullient Learning for BFSI Training?

At Ebullient Learning, we understand the unique challenges of the BFSI sector. Our training programs are designed by industry experts and learning strategists who know what skills truly matter in 2026 and beyond.

What sets us apart:

Customized BFSI modules aligned with industry standards

AI-powered learning experiences for personalized growth

Blended learning models (online + in-person workshops)

Real-world simulations to build practical expertise

We’ve empowered thousands of professionals across India to future-proof their careers and enhance organizational performance.

Final Words: Shape the Future of Banking with Ebullient Learning

The BFSI industry stands at the crossroads of innovation and disruption. To stay relevant, professionals must continuously upgrade their skills in digital finance, compliance, and customer engagement.

Whether you’re an individual aiming to boost your career or an organization striving for excellence, now is the time to invest in BFSI training that prepares you for the future of finance.

At Ebullient Learning, we don’t just train—we transform professionals into future-ready leaders.

explore www.ebullient.in today to our customized BFSI training programs and take the first step toward building a smarter, more resilient banking workforce.

FAQs: BFSI Training 2026 – 7 Skills Every Banker Needs Right Now

1. What does BFSI stand for?

BFSI stands for Banking, Financial Services, and Insurance. It refers to the sector that includes banks, investment firms, insurance companies, and other financial institutions that deal with money management and financial products.

2. Why is BFSI training important in 2026?

In 2026, the BFSI industry is being reshaped by digital transformation, AI, blockchain, and regulatory updates. Training helps professionals stay updated with new tools, technologies, and compliance standards—ensuring they remain competitive and future-ready.

3. What are the top 7 skills every banker needs in 2026?

The most in-demand skills for BFSI professionals include:

Digital literacy & fintech awareness

Data analytics & interpretation

Cybersecurity knowledge

Regulatory & compliance management

Customer relationship management (CRM)

Financial advisory & investment planning

Adaptability & continuous learning mindset

4. Who should enroll in BFSI training programs?

BFSI training is ideal for bank employees, financial analysts, insurance professionals, fintech enthusiasts, and anyone aspiring to build a career in the financial sector.

5. How do digital skills impact banking careers in 2026?

Digital skills are now essential. Automation, AI-based tools, and mobile banking apps are transforming the industry. Professionals with digital expertise can handle advanced customer service tools, detect fraud more efficiently, and analyze financial data effectively.